We promote initiatives to preserve the global environment and protect limited resources.

Initiatives to Reduce Environmental Impact

Reducing Greenhouse Gas (GHG) Emissions

As part of our efforts to combat climate change, we are working to reduce greenhouse gas (GHG) emissions. In addition, we provide products and services that help customers reduce their CO2 emissions.

Activities to Visualize and Reduce our GHG Emissions

We regularly measure and disclose the amount of GHG emissions generated in the course of our business activities. We also set reduction targets and formulate specific action plans to achieve these targets.

Please see here for various environmental data on our group and third-party assurance reports on GHG emissions.

| GHG Emissions Results | 2022 | 2023 | FY2024 | |

|---|---|---|---|---|

| Scope1+2(Market Standard) | 724 | 454 | 457 | |

| Scope 3 | 6,699 | 7,149 | 10,907 | |

| Category 1 (Purchased goods and services) | 5,891 | 5,920 | 9,678 | |

| Category 2 (Capital goods) | 74 | 337 | 219 | |

| Category 3 (Fuel and energy related activities) | 278 | 286 | 285 | |

| Category 6 (Business travel) | 333 | 420 | 530 | |

| Category 7 (Employer commute) | 109 | 145 | 150 | |

| Category 15 (Investment and financing) | 14 | 41 | 45 | |

| Scope 1+2+3 | 7,422 | 7,603 | 11,364 | |

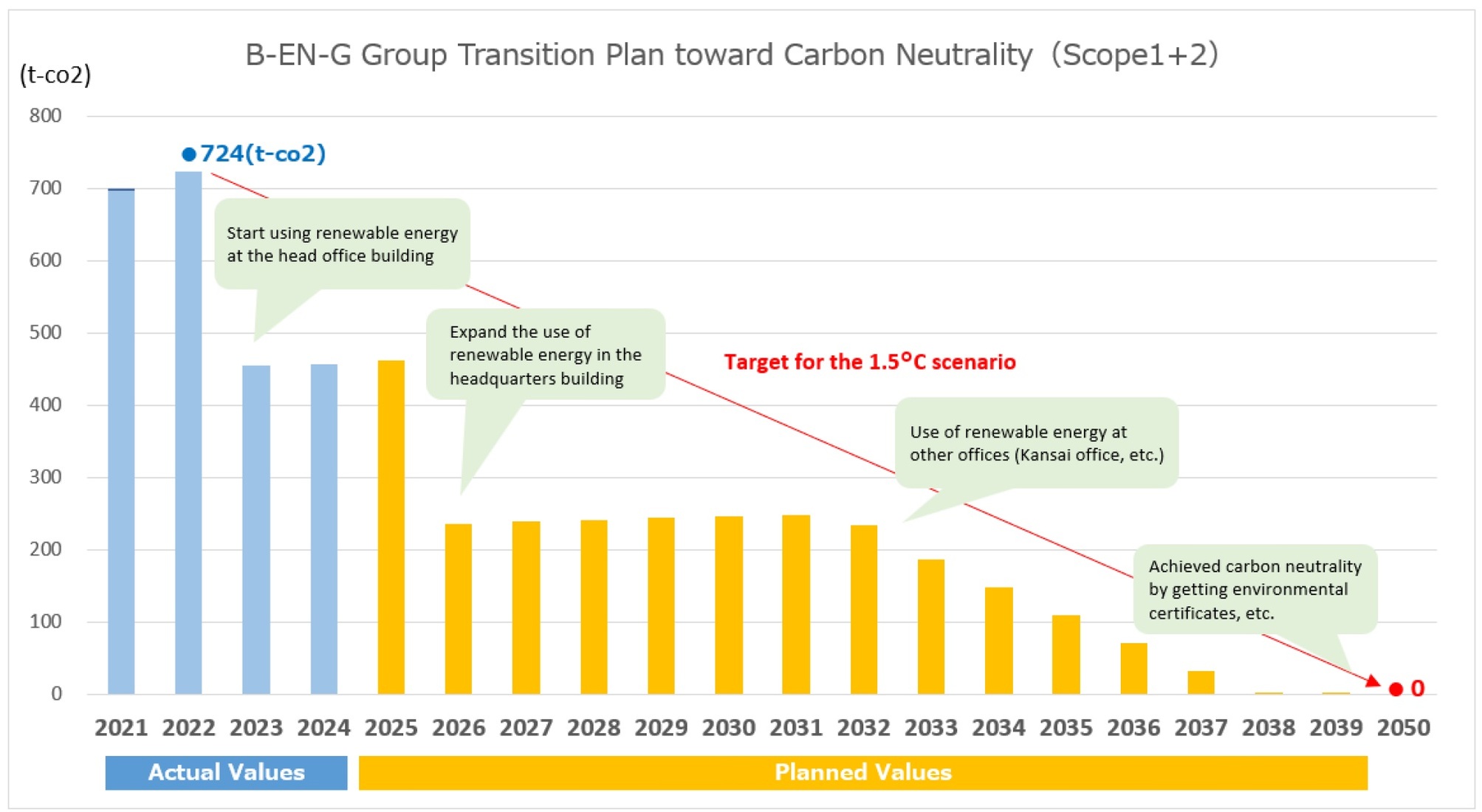

【Reduction targets for greenhouse gas emissions (Scope 1 and 2)】

The Group's greenhouse gas emissions reduction targets are as follows:

We promote initiatives for decarbonization that are consistent with the Paris Agreement and aim to achieve carbon neutrality by 2050.

| Item | Mid-term goal | Long-term goal |

|---|---|---|

| Scope1 and 2 | By 2030, we aim to achieve a reduction of 50% or more from the FY2022 level. | By 2050, we aim to become carbon neutral. |

【Climate Change Transition Plan】

We will strive to procure renewable energy for our head office building until 2030 and reduce our own GHG emissions.

From 2032 onwards, we will gradually begin procuring renewable energy at our locations other than the head office to reduce emissions.

Providing products and services that support companies in promoting carbon neutrality

For our customers in the manufacturing industry, we provide products and services that help us understand the amount of CO2 emitted during manufacturing processes and contribute to efforts to reduce it.

For more information about our product (mcframe CFP), please click here.

Disclosure based on TCFD recommendations

The Group considers addressing climate change as one of its key issues and discloses the impact of climate change on our business by conducting analysis based on the framework recommended by the TCFD.

Process for identifying the impact of climate change on our business

1. Identification of Risks and OpportunitiesOf the various events that could occur as a result of climate change, we have listed those that are relevant to our business and those that we consider to be particularly important.

Scenario Analysis of Social Changes and Their Impact on Our Business

Using external scenarios, we examined the impact of climate change on society and possible events. We also examined how the resulting changes in stakeholder trends would affect our business, organized on a short- to long-term time horizon.

3. Measures to Address Impacts of Climate Change and Calculation of Financial Impacts (*to be disclosed)

We have calculated the specific measures we will take and the financial implications of our response to the risks and opportunities created by climate change.

Governance

The Sustainability Committee, chaired by the President, formulates policies and measures for various initiatives related to climate change. The contents of discussions and important matters considered by the committee are confirmed and resolved by the Board of Directors, and the Sustainability Promotion Office plays a key role in implementing these measures.

Strategy

We conduct analysis using scenarios published by the IEA, IPCC, and other organizations to identify risks and opportunities for our business caused by climate change, as well as the degree of impact. The scenarios used in the analysis are two types: 1.5°C and 4°C or higher for the average temperature increase from pre-industrial times.

| Possible Events | Implications for our Company | Risk /Opportunities |

Solution | time between shaft *1 |

Likelihood *2 |

Impact *3 |

|

|---|---|---|---|---|---|---|---|

| Tighter carbon emissions regulations | Electricity prices will rise due to the increased carbon tax burden and the expansion of the proportion of renewable energy used. | Profitability of the manufacturing industry, our major customer base, will deteriorate, resulting in a decline in IT investment appetite. - Cloud service usage fees will rise, increasing the operating costs of our SaaS business. |

Risk | In addition to the manufacturing industry, the business will also target industries that are not significantly affected by stricter regulations. | Medium-term | Medium | Medium |

| Stricter disclosure requirements | Stricter control of emissions throughout the supply chain and across the corporate group will be required | The market for IT for accurate emissions management will expand | Opportunity | Promote development of new products and services utilizing our expertise in supply chain management and group management accounting (e.g., a system to manage emissions with ERP) | Medium to long term | large | Medium |

| Evolution of emissions measurement technology | Expanding and evolving needs for measurement technologies to improve accuracy, including direct acquisition of carbon emissions | The development of systems for emissions measurement using IoT, etc. will progress and the market will expand | Opportunity | Combine our IoT products and new technologies to expand our products and services (e.g., consulting business for problem solving) | Medium-term | large | small |

| Consumer preference for environmentally friendly products | In line with the preference for environmentally friendly products, information disclosure to consumers, such as the display of carbon emissions for individual products, is increasing | Increasing need for IT to enable product-specific CFP (carbon footprint) management | Opportunity | Expand our existing products and services and bring them to market ahead of competitors | Medium to long term | large | Medium |

| Transition to a low-resource, low-energy society | Resource consumption will be curbed, and the manufacturing industry's business model, which is based on the consumption of goods, will undergo a transformation. |

・Existing products and services will need to be adapted to the new business model. ・The market for supporting business model transformation in the manufacturing industry will form and expand |

risk opportunity |

・Develop products and services that support new business models in the manufacturing industry ・Create new businesses that transform the manufacturing industry into a creative industry |

Long-term | Medium | - |

| Possible Events | Implications for our Company | Risk /Opportunities |

Solution | time between shaft *1 |

Likelihood *2 |

Impact *3 |

|

|---|---|---|---|---|---|---|---|

| Increased severity of natural disasters | The risk of natural disasters such as typhoons and floods will increase, forcing an increase in companies to relocate their factories and other production bases. | Deterioration in customer revenues results in reduced willingness to invest in IT | Risk | Expand the SaaS business, which is less susceptible to disasters and relocation of bases | Medium-term | Medium | small |

| BCPs are being developed for disaster risk | Increased adoption of cloud services as a disaster countermeasure will increase opportunities for SaaS business expansion | Opportunity | Short to medium term | large | Medium | ||

| Stronger and more resilient supply chains against natural disasters will be required | Increased adoption and digitization of IT to improve supply chain resilience and robustness | Opportunity | Promote business by leveraging our strengths in SCM and IT support | Short to medium term | Medium | Medium | |

| Average temperature increase | Increased cooling costs for data centers and server rooms, resulting in higher fees for cloud services | Our SaaS business operating costs will increase | Risk | Pass on cost increases to prices and at the same time, promote measures to improve business efficiency, expand services, and ensure that customer satisfaction does not decline | Short to medium term | large | small |

*1 Short-term: ~5 years (2030), Medium-term: ~15 years (2040), Long-term: ~25 years (2050)

*2 Large: 50% or more, Medium: 5% to less than 50%, Small: less than 5%

*3 Large: 10% or more of sales, Medium: 1% or more of sales, Small: Less than 1% of sales

Risk Management

Our company recognizes that addressing issues related to climate change is an important management issue that not only reduces risk but also leads to profit-earning opportunities, and the Risk Management Committee, chaired by the President, evaluates and manages the risks and opportunities assumed due to climate change. In addition, the Sustainability Committee monitors the details of our response to climate change-related risks, and reports and supervises its activities to the Board of Directors.

Indicators and Targets

We disclose the actual GHG emissions generated by our group's business activities and set reduction targets.

For details, please refer to "Our activities to visualize and reduce GHG emissions" above.