Creating the future of healthcare together

Licensors' thoughts on the future of life sciences

Vol.2 Körber

The international technology group Körber, develops software and services for the pharmaceutical industry, including the MES (Manufacturing Execution System) "PAS-X." With an eye on the next generation of "Pharma 4.0," how does the Senior Vice President Software view the global and Japanese markets? Masakazu Haneda and Yumiko Miyazawa of Business Engineering, which operates in Japan as PAS-X partners, visited Körber Japan's office in Tokyo and held an online conversation with Oliver Weber, SVP Software, Körber Business Area Pharma (Titles omitted throughout the text)

(Online)Oliver Weber, SVP Software, Körber Business Area Pharma

(Photo center) Martin Brillowski,General Manager, Körber Japan

(Left) Masakazu Haneda, President and CEO Business Engineering Corporation

(Right) Director of Business Engineering Corporation Solutions Business Headquarters Deputy General Manager Miyazawa Yumiko

Haneda: Business Engineering (hereinafter referred to as B-EN-G) provides support services for the implementation of Körber‘s MES (Manufacturing Execution System) product "PAS-X" for clients in the pharmaceutical industry. Going forward, the pharmaceutical industry will need to accelerate digitalization, with smart factories in mind, while at the same time complying with increasingly stringent GMP regulations. In this context, we believe it is extremely important to promote the products offered by Körber Pharma and the unique value that Körber Pharma offers to Japanese customers. We also hope to further strengthen our partnership with Körber Pharma and further increase the value we can provide. It was against this backdrop that we requested this interview.

Oliver Weber, SVP Software, Körber Business Area Pharma (OW): Understood. Thank you very much.

PAS-X adopted by global pharmaceutical giant

Haneda: First, please tell us about the Körber Group and Körber Pharma Business Area.

OW: The Körber Group is a technology company headquartered in Germany, and is celebrating its 80th anniversary since its founding in 1946. Its three core business areas are technology, supply chain, and pharma. It has approximately 13,000 employs worldwide and ganerats sales of approximately 3 billion euros.

Of the three business areas, Körber Pharma focuses on the pharmaceutical industry. Its strength lies in its ability to provide value to customers through a comprehensive ecosystem. It has a unique portfolio that spans machines and materials for sterile processing, inspection, and packaging, transportation systems, consulting services, software, and digital and AI-based solutions, and provides services that enable the integration of different layers in the manufacturing process.

Among the software products we handle, PAS-X, mentioned by Mr. Haneda at the beginning, is a prime example. As a software business, we have implemented it and are providing services to eight of the top ten global pharmaceutical companies, and it has been implemented at more than 500 locations for approximately 200 customers worldwide. While the field may be niche, we have established a foothold with this software for over 35 years, and it's fair to say we have become the number one player. PAS-X has also been selected for numerous industry awards.

Responding flexibly to individual customer requests

Haneda: Earlier, you mentioned that different layers in the manufacturing process can be integrated. Specifically, you meant "L2," which monitors and controls the physical manufacturing process, and "L3," which manages the manufacturing operations of the entire factory.

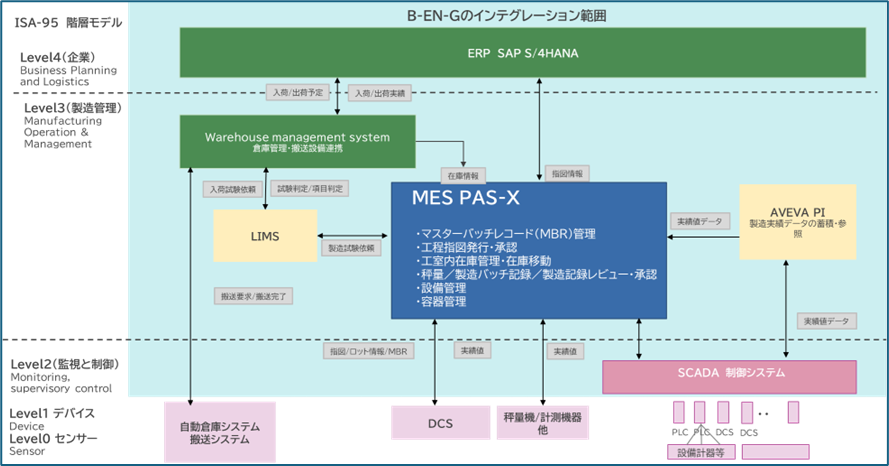

Figure 1 PAS-X external interface standardization and B-EN-G integration scope (Source: Business Engineering)

OW: Yes. At Körber pharma, we believe our approach and solutions are attracting attention and having a significant impact on pharmaceutical companies that want to operate their factories by fully integrating L2, which is responsible for the automatic control of "how to manufacture," and L3, which is responsible for the management and execution of "whether manufacturing is being carried out according to plan and in compliance with quality standards."

Our solution is designed to meet the needs of not only management but also operators as a whole. At the same time, we also place importance on the circumstances of each individual site, allowing each to select what they need and configure it to their preferences. This is because the requirements of each factory are infinitely different. It is precisely because we can effectively adapt to each individual need that we can call it a "perfect solution."

Most of our customers, especially our larger ones, operate 24/7 around the world on a single network, and as they expand into other markets, we follow suit, helping them set up the same production and manufacturing environment they are accustomed to, but according to their specific requirements.

Haneda: I see, so you are already prepared to respond to any request from your customers. I imagine that some of your customers are looking to further advance their manufacturing processes.

OW: When talking about our portfolio, I want to emphasize that our pharmaceutical software suite does not consist of just PAS-X, but that PAS-X Savvy is also an important piece. PAS-X Savvy is software that primarily handles data management and analysis, and it provides powerful support for real-time analysis and visualization of data across departments and locations. For example, when customers build digital twins, they can unify their organizations by sharing all performance data related to manufacturing processes, regulations, and compliance through data aggregation, analysis, and reporting.

We also offer implementation and consulting services, where we collaborate with many partners around the world. Our ultimate goal is to help our customers realize the value of our solutions and products, so we work with partners who have deep knowledge of the products and industries, not just of the individual functions but also of how they integrate with other tools. This is an approach that perfectly complements our product portfolio, and is exactly what Körber and the Körber Pharma business area are focused on.

The Japanese market is a rewarding place to do business

Haneda: I understand that your company is trying to deliver comprehensive value to the pharmaceutical industry, not just with PAS-X, but also with other solutions and services. How do you view the Japanese market?

OW: Let me explain a bit about our organizational structure. We operate in three regions: EMEA (primarily Europe and the Middle East), APAC (Asia Pacific), and the US. Strategically, they are all important, and we want to be successful in all of them.

Körber has grown through success in EMEA, and this region remains the top source of revenue. It is followed closely by the US and then APAC. Looking at it from another perspective, it is important for us to grow our business in APAC, and Japan in particular is one of our core markets, as we believe that what we can offer will translate well into user value.

"Japan is a market that demands exceptional quality, performance, and practical capabilities. It has high standards for software availability and functionality, and a strong respect for compliance, regulations, and international standards. It's a very attractive market, and it plays an important role in our portfolio."

To capture this market, it is essential not only to establish a foothold with global clients who have operations in Japan, but also to grow together with local companies. While supporting the Japanese bases of global pharmaceutical clients such as Novartis and Bayer is one opportunity, we want to grow our business by working closely with our partners in Japan.

At this point, we're not interested in finding a partner that can simply deliver software, etc. We're looking for a true competent partner who adheres to the standards we set in the market, has a deep knowledge of our manufacturing process, and can effectively combine the software stack to realize the value we want to deliver.

Targeting not only major companies

Haneda: We are deploying PAS-X in Japan to customers who require global inspections. What is your company's basic approach? Will you deepen your relationships with the global pharmaceutical industry, or will you broaden your base and focus on mid-sized companies?

OW: Globally, Körber is a market leader in the manufacturing DX/MES field, serving Tier 1 major global pharmaceutical companies as customers. This market is growing at an annual rate of 10-15%, making it a very attractive sector. However, we are also very interested in second-tier companies, which are equivalent to Tier 2, and even the Tier 3 segment in some markets. Here, all the functionality of PAS-X is not necessarily required. We are currently considering providing a simpler version of PAS-X or acquiring a company that provides cloud services for small manufacturers.

There are approximately 6,000 potential pharmaceutical manufacturers worldwide, and they still use paper and pen, or batch records that document manufacturing procedures at a level that cannot be called an MES. However, some of these companies are facing rapid change and increasingly strict regulations. We believe that a solution that can solve the challenges these companies face is necessary, even if it does not necessarily have the same scope as PAS-X. This is why they need a "weighing and dispensing" function that weighs raw materials such as active pharmaceutical ingredients and excipients according to recipes, as well as interim measures to transition from paper-based systems to some kind of MES, such as "paper on glass" (an approach where paper forms can be handled electronically while retaining the image of the existing paper documents).

Due to regulations and other factors, every company will go through a "migration phase" from paper-based or simple batch record-based systems to an MES. This will not be an easy task and will require consulting services. This is an important part of our service offering.

Taking that into consideration, and returning to Mr. Haneda's question, we have a clear interest in the Tier 2 and even some Tier 3 segments. Taking China as an example, of our 40 customers, several are major global companies, but the majority are local companies. We have dedicated personnel in China, but expanding the scale of our business is not an easy task. That's why we need partners.

Haneda: There were many points that I agreed with. There are many second-tier and mid-sized pharmaceutical companies in Japan, and to support them, the full specifications of PAS-X may not be necessary. At the very least, weighing and dispensing functionality is necessary, and I would like to continue exchanging opinions on this matter.

Towards advanced data utilization

Miyazawa: As Oliver's virtual background says "AI-Powered Manufacturing," we too are looking forward to the next phase of the pharmaceutical industry. To utilize the data collected by PAS-X for process improvement, quality assurance, and changes to master batch records, I think it will be important to gain insights from analysis. As you mentioned earlier, does this mean that PAS-X Savvy will be used here? Please tell us about the relationship with PAS-X.

OW: PAS-X and PAS-X Savvy will play a vital role in realizing "Pharma 4.0," which describes the ideal state of digital transformation in the pharmaceutical industry. First of all, PAS-X is an MES that is essential for building a "highly connected" smart factory. It is GMP-compliant and modular, and enables real-time digital control, monitoring, and documentation of all pharmaceutical manufacturing processes, from process development to commercial production and final packaging.

PAS-X also fully integrates with many peripheral systems, such as ERP, document management, quality event management, LIMS, etc. We believe that the greatest strength of our PAS-X solution when it comes to quality and regulatory compliance is that it is the most connected solution on the market.

The challenge for many manufacturing sites is that they already have multiple tools in place, each with a different design philosophy and structure. How do they all connect and where should they keep their core manufacturing records, such as master batch records and electronic batch records (EBRs), in a central location? Many sites struggle with this. They know that these records could be useful for learning, for better reuse, and for providing information to regulatory authorities, but they don't know how to do this. PAS-X is an extremely useful tool for collecting all manufacturing-related data and supporting the manufacturing process to work the way you want it to.

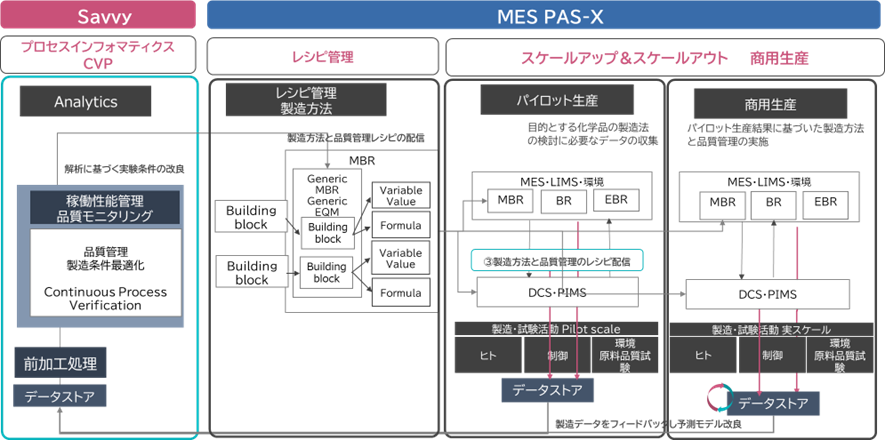

Figure 2: overview of the pharmaceutical development lifecycle and the use of PAS-X Savvy and PAS-X (Source : Business Engineering)

PAS-X Savvy, which you mentioned, plays a vital role in this structure. It's like an analytical tool that sits at the data layer, and can combine all data from different systems, such as manufacturing and quality-related data. We often hear of situations where even large global pharmaceutical companies with over 50 plants around the world don't have access to sufficient information on production performance, downtime, quality issues, and so on at their manufacturing sites. Where exactly can they build a centralized data warehouse that contains all of this information? PAS-X Savvy is the tool that answers that question.

However, PAS-X Savvy also requires more specialized services than PAS-X implementation. It is responsible for visualizing and analyzing manufacturing processes, and requires advanced skills and know-how to function as a "centralized repository" that serves as the basis for various reports. The fact that each company has different goals and uses also contributes to the need for specialized services.

In the context of utilizing collected data, another important aspect is the "design and management of MBR (Master Batch Record)." Many companies face the challenge of "local MBR vs. global MBR." To use a global MBR and deploy and utilize it in different markets, you need the right infrastructure and systems. PAS-X has the functionality and foundation to make this possible, and we help our customers achieve it.

Expectations for a drastic reduction in cycle time

Miyazawa: What do companies that actually introduce PAS-X value? I imagine there are various aspects to consider, such as organizational collaboration from product development to commercial production.

OW: We acquire more than 15 to 20 new customers per year, and most of them are replacing the software they were using previously. I always ask myself, "What made them contact us and ultimately choose PAS-X?" Let's take an example from South Korea. After successfully completing a project with a very large pharmaceutical company, we've been expanding our customer base. Their motivation was that they wanted a solution that could start early in the process. They were concerned about the extremely long time it takes from laboratory qualification—the stage of verifying and documenting that pharmaceutical manufacturing equipment and systems are installed correctly, functioning accurately, and producing the expected results—to actually shipping pharmaceuticals from the factory.

It can take three to six months from manufacturing approval to production. PAS-X can help significantly shorten this time. Its distinctive feature is its ability to convert pre-approval clinical trial manufacturing conditions and performance data into batch records that control the commercial manufacturing process and quality. In this way, PAS-X is an ideal tool for shortening cycle times, and can also make a significant contribution to shortening and reducing downtime in the actual manufacturing process.

Furthermore, PAS-X has been highly praised not only for reducing downtime but also for its ability to consistently ensure high uptime. In large-scale manufacturing, downtime directly increases costs, but in small-scale manufacturing, such as in gene and cell therapy, operational shutdowns themselves can pose risks to patients. PAS-X ensures high availability even in these areas, simultaneously reducing TCO (total cost of ownership) and improving manufacturing reliability. Another important point of praise was the ability to continuously support and educate operators through digital tools, enabling the manufacturing process to run smoothly.

Evaluating the market credibility of local partners

Haneda: You mentioned earlier that you would be focusing on business in the Asia-Pacific region. For example, when you expand into Japan, how do you plan to collaborate with partner companies like us?

OW: Japan is a very attractive market for us, but it is also a very complex market. Experience has shown that to succeed in this market, you need a deep understanding of the local requirements. Therefore, I think it is inevitable for overseas companies to cooperate with local partners when doing business in Japan.

Rather than leaving everything to our partners, we need a strong local team to establish a foothold in the Japanese market. We plan to establish a global structure for Körber by assigning personnel in Japan for roles such as sales, pre-sales, solution architects, and product managers, who will work closely with the project management and software development teams at our German headquarters.

When it comes to delivering the product to the customer's environment and directly communicating with them to solve their problems and meet their requests, that is, client-facing, we want to work with our partners, because they have built up a reputation and trust in the market over many years. When it comes to incorporating customer and market requirements into projects, we always work with partners like B-EN-G.

Miyazawa: We at B-EN-G will work closely with your sales, pre-sales, solution architects, and other people to convey customer feedback.

Making collaboration even more valuable

Haneda: As a partner, it seems there are many ways in which we can contribute beyond providing thorough support to customers.

OW: When I think about close collaboration, I don't want to limit B-EN-G's capabilities to being just a "trusted partner for our customers." A successful partner will have influence over the product roadmap and have influence and access to key people at Körber. In other words, I want them to be a "speaker" to Körber regarding the specific needs of the market.

From my experience, I understand that Japanese companies have different requirements. One size does not fit all. There are also country-specific regulations, so we need to be flexible when planning for the local market. To do this well, I believe it is important for partners to be actively involved in defining the roadmap for the next software release.

Haneda: I understand what you're saying very well. In fact, B-EN-G independently develops and distributes supply chain software aimed at general manufacturing industries. Partners who don't just sell, but also handle implementation and customization, and even provide feedback on products, are extremely valuable and something we must cherish. After hearing Oliver's story, we have renewed our desire to become like that ourselves.

OW: The US, Brazil, France... it's the same everywhere. When we work with partners, we always want their input because they are very close to our customers and they understand their pain points and needs. They are the perfect source of potential inputs for our roadmap planning.

The trend towards smaller batches and individualization

Haneda: Looking ahead to the next 5 to 10 years, how do you see the pharmaceutical industry evolving and what trends do you see continuing?

OW: First of all, the manufacturing DX/MES field, which has major global pharmaceutical companies positioned as Tier 1 as its main customers, is growing at an annual rate of 10-15% globally, making it extremely attractive. The COVID-19 pandemic exposed the lack of sufficient local capacity (local production capacity) and local capabilities (local technology) in many countries and regions to manufacture important pharmaceuticals. Supply chains were victims of globalization. Learning from this experience is one of the driving forces behind growth.

Astonishing advances in medical science and research have resulted in a steady stream of new drugs hitting the market. While countries around the world rushed to develop COVID-19 vaccines, new growth areas such as GLP-1 (a pharmaceutical field that has been gaining attention for its use in treating diabetes and obesity) are driving growth in the pharmaceutical industry.

However, we see a more fundamental change as advances in medical research are leading to smaller and smaller batch sizes and increasingly more personalized products, posing numerous challenges for pharmaceutical manufacturers.

There are often sudden changes in the manufacturing process, such as changing from one batch to the next, or from one location to another, which could mean rethinking the manufacturing process at a plant in the north of the country and switching to a plant in the south. This requires highly connected systems and infrastructure across processes and locations, and this is where we can play a very important role. We have customers with more than 50 plants around the world, and they have a system in place where all the data they get from PAS-X is available anywhere. This is a major advantage.

Increase your presence in the life sciences industry

Haneda: How do you want your company to lead the way amid these market trends?

OW: It's important to note that growth in the pharmaceutical industry is still more of a quantitative growth than a qualitative growth. Factories need to be built, and machines need to be installed in the factories. These machines need to be equipped with software such as L2 and L3. That is what drives growth for us.

The times are also favorable. While there are currently customers who are not too concerned about downtime and can tolerate one of their production lines being down for two days, there are already customers who cannot tolerate downtime of even a few hours or even a few minutes. Going forward, I believe the question of "How can we optimize our existing infrastructure?" will become a more common theme.

When it comes to software upgrades, stopping production lines will no longer be an option. Many technologies will move to cloud or cloud-native environments, ensuring continuous improvement in manufacturing processes. Thus, growth will not only be driven by advances in scientific research, but also by the growth of the middle class around the world.

There are some impressive figures about how the middle class will grow over the next decade or so. Their medical supply requirements will be diverse, and as a result, the pharmaceutical industry is expected to merge with the life sciences industry, which refers to a wide variety of cutting-edge research-based industries, from agriculture to biotechnology.

Körber has launched a 10-year vision program called "LIFE 2035." The name is an acronym for Leadership, Innovation, Financial Independence, and Empowerment, and describes the company's vision for the next 10 years. Körber's key goal is to become a significant player in the life sciences industry. As a result, the company aims to become a 10 billion euro company with 60,000 employees in the future.

For the development of local players

Haneda: There will likely be an oligopoly by large companies through acquisitions, but with the development of diverse life sciences, small-scale manufacturing companies that specialize in niche areas will also flourish. So you're saying you want to support both.

OW: While large global pharmaceutical companies (Tier 1) remain at the core of the market, I believe that local players equivalent to Tier 2 and Tier 3 will play an increasingly important role in the future.

Take for example Switzerland, where I live: a very small but demanding market compared to other countries. There are big players like Roche and Novartis, but also at least 500 smaller players producing medicines.

The same is true in Italy, where small, family-run pharmaceutical companies are a major force in the market. In many cases, manufacturing processes and quality control rely on "pen and paper." Digitalization will likely become a major driving force in this segment of mid-sized and second-tier companies in the future. This is why we want to offer simpler solutions that fit this segment.

Turning back to the Japanese market, I personally view the possibility of working with B-EN-G to consider the second-tier and mid-sized enterprise market very positively. We already have some data on the second-tier and mid-sized enterprise market in Asia, including requirements, price ranges, and implementation models, so if the opportunity arises, I would like to exchange opinions in another session.

Haneda: Yes, thank you very much. Looking to the future, I would like to deliver this message to Japanese customers.

Company Profile

Company name: Körber Japan Co., Ltd.

Founded: May 8, 1995

Business: Consulting services for visual inspection machines, packaging machines (blister, cartoner), conveyors, MES (manufacturing execution systems) software (PAS-X, etc.), traceability systems (Track & Trace), GxP/CSV/DI, etc.