PT. Toyo Business Engineering Indonesia (hereinafter referred to as B-EN-G Indonesia) is one of the overseas subsidiaries of Business Engineering (hereinafter referred to as B-EN-G) and is based in Indonesia. Established in 2015, B-EN-G Indonesia sells, introduces, and maintains B-EN-G products, including the manufacturing business package "mcframe," mainly in Indonesia.

This time, we spoke candidly with members of B-EN-G Indonesia, PT Asahi Networks Indonesia (hereinafter Asahi Networks), the local Japanese accounting firm to which B-EN-G Indonesia has outsourced its bookkeeping services, and the accounting department at B-EN-G's headquarters, about the background to the company's introduction of "GLASIAOUS," a cloud-based international accounting and ERP service provided by B-EN-G, as well as the company's implementation and full operation.

The motivation, challenges, and background for introducing cloud ERP

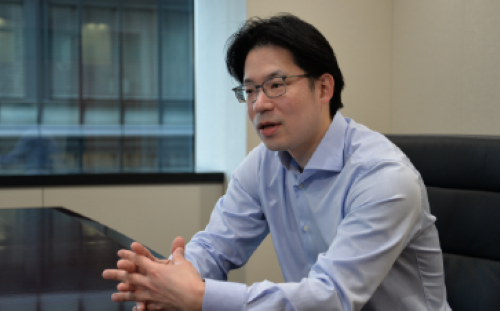

B-EN-G Indonesia Sasaki:

B-EN-G Indonesia is a small company with only 16 employees, so we did not have a specialist in accounting and asked Asahi Networks to do the bookkeeping for us. We also took the approach of running our own affairs.

PT. Toyo Business Engineering Indonesia

(B-EN-G Indonesia)

President Director Jun Sasaki

At the time, the common system alone was not enough to check everything, so we asked the accounting department at B-EN-G's headquarters to help us, and we had to use Excel because there was no accounting system among the three companies, so the communication was inefficient, and we also managed sales and purchasing data in a shared spreadsheet on Google Drive. However, it was still manual work to connect estimates, orders, sales, etc., so we were worried about how to do something about that. Since we are in a position to support the introduction of systems in our own company, we have always thought that our company's inability to do so was an issue.

Even before COVID-19, we wanted to systemize our accounting operations. Previously, we were using spreadsheets, which made it difficult to link data in order management. We also converted invoices and other documents into PDF data and managed them in folders, but this was cumbersome and we felt we had limitations. Once, we discovered a mistake during monthly accounting, which meant we had to revise our P&L and B&L after the fact, which caused trouble for both Asahi Networks and the accounting staff at B-EN-G headquarters.

As for monthly P&L and profit, although the list of purchases and sales during the month could be viewed on a spreadsheet, monthly profits could not be ascertained until the invoices for the month were submitted to Asahi Networks and the invoices were bookended. As a manager, I could roughly tell if profits were currently being made, but it was a situation where I could only know for sure after one or two months. As a company that supports the introduction of business systems for other companies, I felt that the fact that our company had not systematized itself was an issue. With this in mind, we began to seriously consider introducing GLASIAOUS in April 2020, and began the introduction work in July. It went live in January 2021, and since then, we have been able to see the P&L as soon as we register sales and purchases, which has helped us make management decisions faster and has been very helpful.

Issues and Background

[B-EN-G Indonesia]

・There is no accounting staff, so we asked an accounting firm to do the bookkeeping for us

・Sales and purchasing data is managed by three companies (B-EN-G Indonesia, Asahi Networks, and B-EN-G Headquarters) using Google Spreadsheets, making it difficult to link data in order management.

[B-EN-G Head Office]

- The contents of the spreadsheet are not properly transferred to accounting data

[Asahi Networks]

・It is difficult to share information in documents

point

① The limitations of sharing via spreadsheets

② Inefficiency leads to human error

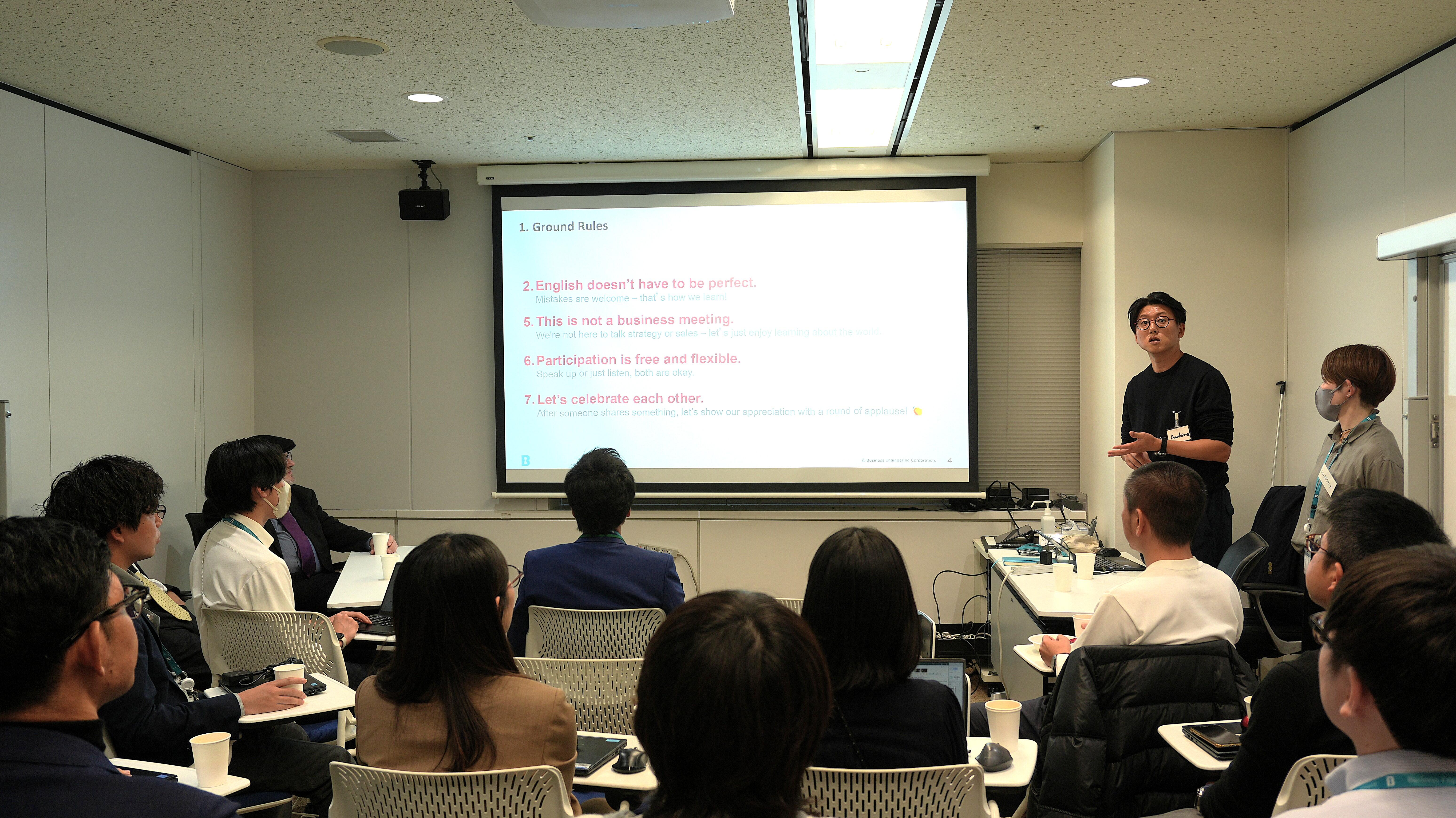

Asahi Networks, a bookkeeping service, describes the operational challenges they faced before implementing GLASIAOUS.

Left: PT Asahi Networks Indonesia

Walla Astianty Putri, Senior Consultant (Accounting)

Right: PT Asahi Networks Indonesia

Consultant (Accounting) Raisa Bryantia

Asahi Networks, Mr. Walla and Ms. Raisa:

Before the introduction of GLASIAOUS, it was difficult to share information on documents necessary for bookkeeping. Specifically, when B-EN-G Indonesia shared documents with us, Mitsuhashi from the accounting department at B-EN-G's headquarters first checked the documents from B-EN-G Indonesia, and then B-EN-G headquarters shared the information. With GLASIAOUS, we can attach documents to the system, making it easier to share.

Business Engineering Corporation (B-EN-G Head Office)

Accounting Department Yuji Mitsuhashi

B-EN-G Head Office Accounting Department:

Previously, we would create supplementary information in Excel and give it to Asahi Networks to input into their accounting system, but there was an issue with spreadsheets not being easily transferred to accounting data. The accounting department at the head office used to create somewhat complicated lists of purchase and sales schedules, but this involved creating lists at the head office and then inserting them into the documents managed by Asahi Networks. This has now been resolved.

Indonesia's unique challenges, including business practices, tax systems, and accounting practices

B-EN-G Indonesia Sasaki:

There are two main ones. The first is Withholding Tax(WHT). Many countriesusually useVAT (value-added tax), but in Indonesia, WHTis also included in transactions. The other is a system for tax payment owned by the government, and it is Indonesian business practice to input transaction data into this system and connect it to the government's tax payment processing.

PT Asahi Networks Indonesia

President Director Yoshiro Okamoto

Mr. Okamoto of Asahi Networks:

It is true that withholding tax is a result of the country being one that believes in evil, but because the tax is paid in advance for each transaction, this is called withholding tax and must be reported monthly. This is difficult for Japanese people to understand, and people coming from Japan for the first time may start off by asking, "How does this work?" and trying to understand the system.

Historically, the VAT tax system has been changed many times, and each time it has been changed, the practice has become confused. The background to this is that there have been many cases of tax embezzlement by processing as if VAThad been paid and then applying for a refund, so I understand that there has always been a desire to prevent such situations from occurring. Currently, all transactions related to VATby each company are centrally managed by the tax office's system. Since all information on transactions that incur VAT is managed by the system, theVAT transactions and declarationsare complicated, but from the administrative side, it is a system that makes it difficult for mistakes and fraud to occur. I get the impression that tax administration is more electronic than in Japan, but only the parts that are convenient for the administrative side are electronic. Considering the convenience of taxpayers, it would be better if it were a more integrated system.

Also, infrastructure issues can cause the Internet to suddenly cut off or slow down. Of course, such situations occur in Japan as well, but unless the network infrastructure becomes a little more stable, it will be difficult to trust the system and we will be using it with a constant sense of anxiety.

B-EN-G Indonesia's Sasaki:

The Indonesian rupiah is a currency that can be rounded down to two decimal places, but when the tax is calculated and the result is 10%, it is natural that a fraction will be rounded down to two decimal places, and the amount rounded down to two decimal places is the tax. Although the system has a rounding function, it does not yet have a function to round down to the nearest decimal place when calculating the tax amount. In other words, when the tax amount is 12.56, the correct tax amount would be 12.00, but since the system has rupiah to two decimal places, it does not yet have a function to select where to round down. This is a special case that is only applicable when calculating tax.

PT Asahi Networks Indonesia

Manager Naoya Inada (Japan Desk)

Mr. Inada of Asahi Networks:

There are some problems that are unique to Indonesia that arise because of the complicated tax rules in Indonesia. There are no coins in Indonesia that are less than 100 rupiah, so Indonesians don't care about 1 rupiah itself. For example, if the bill is 100.01 rupiah but the payment is only 100 rupiah, there will be a difference of 0.01 rupiah and you will have an account receivable. However, as a unique tax rule in Indonesia, it is tolerated under commercial customs. For Japanese people, this fraction of 0.01 may be a concern.

In addition, there are separate rates for tax and accounting, so if you make a payment in Japanese yen, when you receive an invoice, two rates will be shown: "Use this rate for tax purposes and this rate for accounting purposes." There are problems unique to Indonesia that arise due to the complicated tax rules in Indonesia. Even if the withholding tax is 10%, the Japanese yen x rate part is different, so it may not be the 10% amount for accounting purposes. This is often a problem when introducing a system, and we have asked the product provider whether the tax rate and accounting rate can be used separately.

B-EN-G Indonesia's business activities, history and characteristics (B-EN-G Indonesia, Mr. Sasaki)

Founded in 2015, the company sells, implements, and maintains B-EN-G's mcframe production management package as a licensor. The GLASIAOUS ERP/accounting package version (mcframe GA) that was introduced to B-EN-G Indonesia this time was also introduced to Indonesian customers for support.

Since we have production management products, we have many customers in the manufacturing industry, and there are now more than 50 mcframe users.

Our strength is that we have members who are strong in production management and accounting, so we can propose, implement, and maintain the system in-house. We are a small company of about 15 people compared to B-EN-G's overseas bases in Shanghai and Thailand, but the number of users for whom we provide services, including maintenance, is increasing year by year.

We are conducting sales activities within Indonesia, but we also provide implementation support (GLASIAOUS) to existing users in Singapore, Malaysia, Thailand, and the Philippines.

About Asahi Networks (Mr. Okamoto, Asahi Networks)

We started our business in April 2012. After the Lehman Shock, there was a surge in Japanese companies expanding overseas, and this was the time when many Japanese companies entered Indonesia. We established an Indonesian corporation in a joint venture with a group company of Asahi Tax Corporation, a medium-sized major Japanese tax accountant corporation with approximately 600 employees.

My wife (Indonesian) and I started with zero customers and now we have a total of just under 50 people.

There are three overseas corporations bearing the name Asahi Networks: in Indonesia, Thailand, and the Philippines, but we also have partner offices in China, Vietnam, and India. Although these corporations have no capital ties with Asahi Tax Corporation, we work together as a group with the awareness of forming an accounting firm that is strong in overseas business, and the representatives of the overseas corporations hold regular monthly meetings and face-to-face meetings once every three months, as well as irregular meetings with the partner offices.

All of the Japanese staff who provide services for Japanese companies at our overseas subsidiaries are locally employed, not expatriates. There are three members of the Japan Desk in Indonesia, but they do not return home, so we believe that a strength of ours is that we can provide consistent services to our clients by having the same person in charge.

About Asahi Networks Indonesia's Services

Although we are an accounting firm, we offer a wide range of one-stop services, starting from pre-expansion support, such as providing investment-related information to Japanese companies wishing to enter Indonesia, to company establishment support, our main business of accounting and tax services, and even audit services provided by our partner auditing firm.

In addition, most of our clients are Japanese companies, but we provide services not only to companies that have expanded into Indonesia, but also to Japanese companies that have expanded into Japan and other Asian countries. We work with a wide range of clients, including manufacturing, trading companies, IT-related, and other service industries, but most of our clients are partner companies involved in motorcycle and automobile manufacturing, and many of them are requesting the creation of cost accounting systems, so we consult with Mr. Sasaki of B-EN-G Indonesia.

*This interview is current as of December 2021.